Setting a Product as Tax-Exempt

In many countries there are products and services on which taxes are not applied. In the United States, for example, you are not required to charge taxes if you are selling services (e.g. a legal consultation, graphic design services, etc.). You are also typically not required to pay sales taxes on products that are delivered electronically to your customers, as long as no physical product (e.g. a CD, a manual, etc.) is shipped to the customer.

ProductCart allows you to set individual products as tax-exempt. This way you can configure general tax settings for your store, and then exclude from them products and services on which taxes should not be calculated.

ProductCart allows you to set individual products as tax-exempt. This way you can configure general tax settings for your store, and then exclude from them products and services on which taxes should not be calculated.

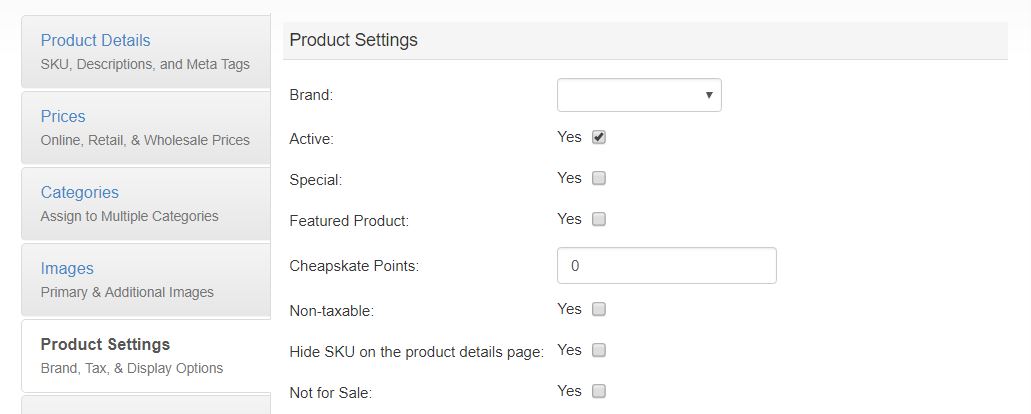

You can set a product as non-taxable both when adding a new product and when modifying a product. In both cases, notice the Non-Taxable check box locate in the Product Settings section of the page. Check this option to make a product non-taxable, then save the product information to the database.

If an order contains both taxable and non-taxable items, taxes will be calculated on the subtotal for the taxable products.

ProductCart allows you to set individual products as tax-exempt. This way you can configure general tax settings for your store, and then exclude from them products and services on which taxes should not be calculated.

ProductCart allows you to set individual products as tax-exempt. This way you can configure general tax settings for your store, and then exclude from them products and services on which taxes should not be calculated.

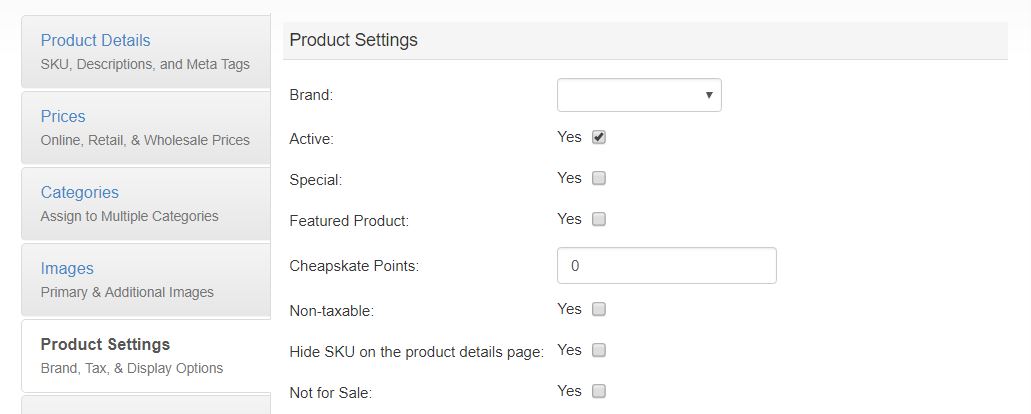

You can set a product as non-taxable both when adding a new product and when modifying a product. In both cases, notice the Non-Taxable check box locate in the Product Settings section of the page. Check this option to make a product non-taxable, then save the product information to the database.

If an order contains both taxable and non-taxable items, taxes will be calculated on the subtotal for the taxable products.